Axius Capital focuses on the global growth markets. Some call these emerging or frontier markets but that nomenclature seems a little outdated and, anyway, no one seems to be able to agree which of these countries fit those labels anyway. Our focus is outside the OECD which is where global growth can be found these days.

The geographic focus is represented by the G77 group. Within the global growth markets, our core strength is in Africa, Asia and the Middle East. Our home bases of London & Dubai are major hubs of business and finance for these regions, which provides us preferential access to money flow and deal flows for these region where more than half of world’s population lives:

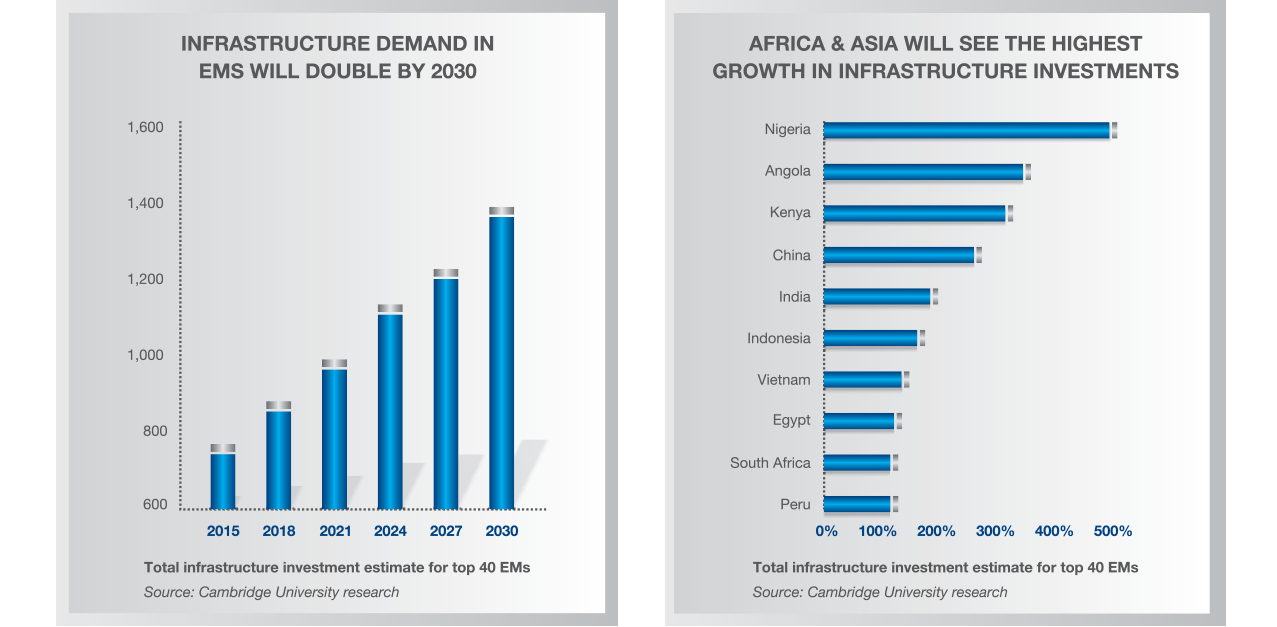

One of the strongest investment themes in global growth markets is infrastructure development. Infrastructure investment needs of the growth markets globally are well documented and Axius Capital is playing an important role in facilitating accelerated institutional investment in infrastructure in these markets, both from local institutions such as pension funds and insurance companies as well as from international investors.

Axius Capital is incubating a number of investment concepts that seek to deliver the true promise of infrastructure as a unique asset class to a wide range of investor group.

Long term nature |

Long term nature of infrastructure cash flows enables investors to better match their assets & liabilities |

Low correlation and volatility |

Operating and financial performance of underlying projects has low or no correlation to macro environment |

Diversification |

Enables diversification away from traditional asset classes |

Yield orientation |

A large part of total investment returns is in form of current yield |

Inflation hedge |

Infrastructure investments can provide a hedge against inflation |

Principal preservation |

High degree of downside protection through strong physical asset base and robust contracts, often backed by sovereign entities |

Strong risk-adjusted returns |

Over long term, Infrastructure has outperformed other assets after adjusting for risks |

Axius Capital is active in providing strategic financial advice to clients operating in or evaluating projects in growth markets. By leveraging the long and distinguished track record of its team members, Axius Capital also spearheads financing transactions across multiple sectors in these markets.

Axius Capital's extensive client base and unrivalled relationship network provides it a unique ability to structure and place financing transactions across the capital structure. A particular strength of Axius Capital is the access to institutional investors globally, that have emerged as an important source of long-term financing for projects and businesses in growth markets. Axius Capital team also have extensive relationships with local banks, international banks as well as ECAs and DFIs.

Philip is the founder and CEO of Axius Capital. Since its founding in 2013, Philip has led Axius in developing a unique investment framework for infrastructure investments in emerging markets, focusing on channeling institutional capital into long-term projects.

He trained and qualified as an ACA with Touche Ross (now Deloitte LLP) in London in 1993 and has spent the past over 20 years working in emerging and frontier markets with Deutsche Bank, EFG-Hermes and Bank of America Merrill Lynch. Philip has executed numerous transactions in these markets across a wide range of sectors, including infrastructure, energy and financial services.

Between 2013 and 2015, Philip was the CEO of Exotix, a frontier market focused merchant bank, where he led the strategic growth of its business with particular focus on equity and capital markets in Africa.

Anshul is the CIO of Axius Capital. He has over seventeen years’ experience in emerging markets infrastructure, with focus on principal investments, project finance and M&A advisory. He has financed and invested in dozens of projects across power, energy, utilities and transport sectors with investment value of c. USD50 billion.

Anshul was the founding team member and MD of MENA Infrastructure Fund, where he originated and executed a large number of investments and managed the fund’s portfolio of USD200 million. He has also executed and managed principal investments for IFC, Bank Muscat, Veolia Water and an Indian financial institution.

Anshul’s experience in infrastructure spans across the capital structure – senior and sub-debt, mezzanine and equity – in different sectors and jurisdictions. He holds a bachelor degree in Chemical Engineering and has an MBA in Finance.

Date |

Title |

|

2012 |

Seeking the best value within the infrastructure industry |

|

2013 |

Structured Finance: Conditions for infrastructure project bonds in African Markets |

|

2015 |

Trends & Opportunities in Emerging Markets |

Send us an email at

philip@axius-capital.com

P.O.Box 191081, Dubai, UAE

You can also follow us on

![]()

![]()

![]()

![]()